Text 4 As the country with the European Union's faslest ageing population,Gennany has repeatedly adjusted its pension system to avert a slow-motion demographic disaster.The biggest reform came during Angela Merkel's first term as chancellor.Then,as now,Christian Democrats were yoked with Social Democrats in a"grand coalition".In 2007 the coalition decided that the normal retirement age should gradually rise from 65 t0 67.Mrs Merkel has since preached similar demographic and econonuc wisdom to most of her EU partners,crilicizing France in particular ror straying off the right path.So it comes as something of a shock that Mrs Merkel,now in her third term and running another grand coalition,is reversing course.On the campaign trail for last September's election,she promised to raise pensions for older mothers.The Social Democrats countered wiLh promises to let certain workers retire at 63 instead of 65.As coalilion partners,they will do both at once.It falls to Andrea Nahles,the labour minister and a Social Democrat who likes to wave the banner of"social justice",to push the pension package through parliament by the summer so that it can take effecl on July lst.A previous reform let women with children born after 1992 treat three of their stay-at-home maternily years if Lhey h8d worked and paid full pension contributions.The new"mother pension"will be for the 8m-9m women who took time off for children before 1992.They will be allowed to count two of those years,instead of just one,as working years for pension purposes.The second part of Mrs Nahles's reforms,retirement at 63,is aimed at people who have contributed to the pension system for at least 45 years.But Mrs Nahles wants to count not only years spent working or caring for children or other family members but also periods of short-term unemploy-ment.Separately,she will also boost the pensions of people who cannot work due to disability,and spend more money to help them to recover.Individually,these proposals may seem noble-minded.But as a package,the plan is"short-sighted and one~sided,"thinks Axel Bersch-Supan,a pension adviser at the Munich Centre for the Economics of Ageing.It benefits the older generation,which is already well looked after,at the expense of younger people who will have to pay higher contributions or taxes."The financial and psychological costs of the pension al 63 are disastrous,"Mr Bersch-Supan says.There wiU no longer be any incentive to keep working longer.In some cases,people may,in effect,retire at 61,register as unemployed for two years,and then draw their full pensions.

Pension system in Germany has been adjusLed to_____

- A.avert ageing trend

- B.tackle ageing problem

- C.avoid a natural disaster

- D.reduce ageing population

正确答案及解析

正确答案

解析

细节题。根据pension system和Germany两个关键词定位到第一段首句:As the country Withlhe European Union's fastest ageing population,Cermany h8s repeatedly adjusted its pension syslem to avert a slow-motion demographic disaster.答案句为avert a slow-motion demographic disaster“避免人口增长缓慢带来的人口灾难”。选项[A]avert ageing trend“避免老龄化趋势”;文章说的是avert demographic disaster“避免人口灾难”而非“ageing trend”,故该项错误。[B]Lackle ageing problem“应对老龄化问题”;文章提到德国fastest ageing populalion“老龄化速度最快”,又提到avert demographic disaster“避免人口灾难”,可见德国一再调整养老金体系的目的是应对人口老龄化问题,该项表述正确。[C]avoid a natural disaster”避免自然灾害”;文章说的是“避免人口灾害”,该项属于典型的偷换概念。[D]reduce ageing population“减少老龄人口”;该项与[A]类似,老龄人口无法减少,该项错误。综上,本题选择[B]。

包含此试题的试卷

你可能感兴趣的试题

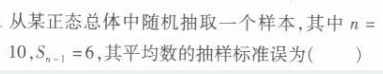

-

- A.1.7

- B.1.9

- C.2.1

- D.2.0

- 查看答案

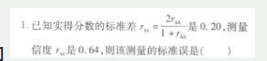

-

- A.0. 60

- B.0.50

- C.0. 12

- D.0.20

- 查看答案

如何理解今年一季度经常账户逆差的原因和影响?

- 查看答案

M 公司是一个无负债公司,其每年预期税息前收益为 10000 元,股东要求的 权益回报率为 16%,M 公司所得税率为 35%,但没有个人所得税,设所有交易 都在完善的资本市场中运行,问: A.M 公司的价值为多少? B.如果 M 公司借入面值为无负债公司价值的一半的利率为 10%的债务,债务 没有风险,并且所筹集的债务资金全部用于赎回股权,则此时公司的价值变为多 少?而权益资本成本为多少

- 查看答案

中美贸易失衡的原因并评价特朗普的贸易政策?

- 查看答案