Text 3 Olivia Pedersen thought the Nissan Leaf parked outside her favourite lunch spot near Emory University,must be hers.But she could not open the door.Nor could she open the door of the identical Leaf behind it.Cautiously,she tried the third Leaf in line and happily drove away.More than 14,000 electric vehicles are now registered in Georgia;California is Lhe only state with more.But the juicy state incentives for buying ihem are coming under aUack.Residents can claim an income-tax credit for 20%of the cost of leasing or purchasing an electric vehicle,up to$5,000.Combined with a possible federal tax incentive worth$7,500,savvy Georgians are driving all the way to the bank in nearly-free electric cars.Nissan sells more of its Leaf models in Adanta than in any other city,according to Don Francis from Georgia,which promotes the use of cars like these.Such trends motivated Chuck Martin,a representative in Georgia's House,to sponsor a bill to end state incentives for electric vehicles.He argues that the income-tax credit costs too much-about$13.6m in 2013-and that only urban types benefit from these sorts of cars.Mr Martin's bill was voted down in committee in February,but seems to be still breathing.Another House bill,mostly to finance transport projects,would reduce the credits;it is now before the Senate.Fans of electric vehicles say Ceorgia now leads the country in clean transport.Local power companies have helped by offering off-peak prices of l.3 cents per kilowatt hour for charging the cars at night.And the sales tax levied on this power stays in the state,whereas cash spent on petrol largely goes elsewhere,says Jeff Cohen,founder of the Atlanta Electric Vehicle Development Coalition.Cutting the credits alLogether might also harm Georgia in other ways.A study by Keybridge Public Policy Economics,a consultancy,says the stale could lose$252m by 2030 if they disap-pear and people buy gas-guzzlers instead.That is because drivers will spend$714m on petrol to get around(in contrast with the$261m they would have paid in electricity bills),and will no longer fritter away their savings from the federal electric-vehicle tax crediL in Georgia's shops.But the state's incentives may be safe in the legislature after all;the president of the Senate drives an electric car himself.

According to Paragraph l,Georgia may______

- A.be under attack for its unreasonable policies

- B.encourage people to purchase electric vehicles

- C.end state incentives for buying electric cars soon

- D.have the largest number of electric cars in America

正确答案及解析

正确答案

解析

细节题。根据Georgia定位到第一段后两句:More ihan 14,000 elecLric vehicles are now registered in Georgia;Califomia is the only state with more.But the juicy state incentives for buying Lhem are coming under attack.选项[A]be under attack for its unreasonable policies“因为其不合理的政策而受到抨击”;原文juicy incentives指“诱人的激励政策”,该项的unreasonable policies“不合理的政策”与之不符,故该项错误。[B]encourage people to purchase electric vehicles“鼓励人们购买电动汽车”;原文明确提到the juicy state incentives for buying them“购买电动汽车诱人的激励政策”,选项encourage“鼓励”=incentives“激励”;purchase=buy;elecLric vehicles=them;该项与原文是同义替换关系,该项正确。[C]end stale incentives for buying electric cars soon“很快结束购买电动汽车的地方激励政策”;其中soon-词过于绝对,文章提到这些激励政策受到抨击,但是没有说这些政策会很快结束.end-词程度夸大。综合上下文,Georgia是一直在实行电动汽车购买激励政策的。故该项错误。[D]have the largest number of electric carsin America“拥有美国数量最多的电动汽车”:原文明确提到Califomia is the only state with more.即加州电动汽车数量最多,Georgia排名第二,故该项错误。综上本题答案为[B]。

包含此试题的试卷

你可能感兴趣的试题

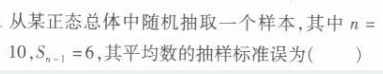

-

- A.1.7

- B.1.9

- C.2.1

- D.2.0

- 查看答案

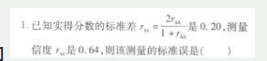

-

- A.0. 60

- B.0.50

- C.0. 12

- D.0.20

- 查看答案

如何理解今年一季度经常账户逆差的原因和影响?

- 查看答案

M 公司是一个无负债公司,其每年预期税息前收益为 10000 元,股东要求的 权益回报率为 16%,M 公司所得税率为 35%,但没有个人所得税,设所有交易 都在完善的资本市场中运行,问: A.M 公司的价值为多少? B.如果 M 公司借入面值为无负债公司价值的一半的利率为 10%的债务,债务 没有风险,并且所筹集的债务资金全部用于赎回股权,则此时公司的价值变为多 少?而权益资本成本为多少

- 查看答案

中美贸易失衡的原因并评价特朗普的贸易政策?

- 查看答案