During her junior year of high school,Diane Ray's teacher handed her a worksheet and instructed the 17-year-old to map out her future financial life.Ray pretended to buy a car,rent an apartment,and apply for a credit card.Then,she and her classmates played the"stock market game",investing(投资)the hypothetical(虚拟的)earnings from their hypothetical jobs in the market in the disastrous fall of 2008."Our pretend investments crashed,"Ray says,still frightened."We got to know how it felt to lose money."

That pain of earning and losing money is a feeling that public schools increasingly want to teach.Forty states now offer some type of financial instruction at the high-school level,teaching students how to balance checkbooks and buy stock in math and social-studies classes.Though it's too early to measure the full influence of the Great Recession(大萧条),the interest in personal-finance classes has risen since 2007 when bank failures started to occur regularly.Now,many states including Missouri,Utah,and Tennessee require teenagers to take financial classes to graduate from high school.School districts such as Chicago are encouraging money-management classes for kids as young as primary school,and about 300 colleges or universities now offer online personal-finance classes for incoming students."These classes really say,'This is how you live independently,'"says Ted Beck,president of National Endowment for Financial Education.

Rather than teach investment methods or financial skills,these courses offer a back-to-the-basics approach to handling money:Don't spend what you don't have.Put part of your monthly salary into a savings account,and invest in the stock market for the long-term rather than short-term gains.For Ray,this means dividing her earnings from her part-time job at a fast-food restaurant into separate envelopes for paying bills,spending and saving."Money is so hard to make but so easy to spend,"she says one weekday after school."That is the big takeaway."

Teaching kids about the value of cash certainly is one of the programs'goals,but teachers also want students to think hard about their finances long term.It's easy for teenagers to get annoyed about gas prices because many of them drive cars.But the hard part is urging them to put off the instant satisfaction of buying a new T-shirt or an iPod."Investing and retirement aren't things teenagers are thinking about.For them,the future is this weekend,"says Gayle Whitefield,a business and marketing teacher at Uth’s Riverton High School.

That’s a big goal for these classes:preventing kids from making the same financial missteps their parents did when it comes to saving,spending,and debt.Though the personal savings rate has increased up to 4.2 percent,that’s still a far distance from 1982,when Americans saved 11.2 percent of their incomes.“It’s hard for schools to reach strict money-management skills when teenagers go home and watch their parents increase credit-card debt.It’s like telling your kids not to smoke and then lighting up a cigarette in front of them,”Beck says.

Even with these challenges,students such as Ray say learning about money in school is worthwhile.After Ray finished her financial class,she opened up a savings account at her local bank and started to think more about how she and her family would pay for college.“She just has a better understanding of money and how it affects the world,”says her mother,Darleen-and that’s sown to the details of how money is spent from daily expenses to various taxes.All of this talk of money can make Ray worry,she says,but luckily,she feels prepared to face it.

36.The“stock market game”mentioned in Paragraph 1 is meant to( ).

A introduce a new course to students

B help students learn about investment

C teach how to apply for a credit card

D encourage students’personal savings

How does the writer show us that schools’interest in teaching financial classes has increased in paragraph 2?

- A.By giving examples

- B.By providing data

- C.By raising questions

- D.By making comparisons

正确答案及解析

正确答案

解析

根据“Now,many states including Missouri,Utah,and Tennessee require teenagers to take financial classes to graduate from high school.School districts such as Chicago are encouraging money-management classes for kids as young as primary school,and about 300 colleges or universities now offer online personal-finance classes for incoming students.”可知,作者通过举例子的方式来说明学校对教授金融课的兴趣的增加,故本题正确答案选A。

包含此试题的试卷

你可能感兴趣的试题

下列关于公司的表述,正确的是()

-

- A.子公司不具有法人资格

- B.分公司具有独立承担民亊责任的资格

- C.—个自然人只能投资设立一个一人有限责任公司

- D.一人有限责任公司的注册资本最低限额为人民币十万元。股东可分次足额缴纳公司章程规定的出资额

- 查看答案

以下各项列举了我国常见气象灾害与其发生地区的对应关系,其中正确的一项是()

-

- A.洪涝一西北地区

- B.洪涝一东北地区

- C.春旱一华南地区

- D.伏旱一华北地区

- 查看答案

根据电视收视率调査,看体育节目的观众中青年人比中老年人要多。

由此可推断出()

-

- A.体育节目可能更适合青年人的兴趣

- B.体育节目是专属青年人的运动

- C.中老年人不喜欢体育节目

- D.青年人比中年人更擅长体育运动

- 查看答案

—种海洋蜗牛产生的毒素含有多种蛋白,把其中的一种给老鼠注射后,会使有两星期大或更小的老鼠陷入睡眠状态,而使大一点的老鼠躲藏起来。当老鼠受到突然的严重威胁时,非常小的那些老鼠的反应是呆住,而较大的那些老鼠会逃跑。

以上陈述的事实最有力地支持了以下哪项假说?()

-

- A.非常小的老鼠很可能与较大的老鼠一样易于遭受突发性的严重威胁

- B.注射到鼠体的包含在蜗牛毒素中的蛋白的主要功能是通过诱导蜗牛处于完全的静止中而起到保护蜗牛的作用

- C.如果给成年老鼠大剂量地注射这种蛋白质,也会使它们陷入睡眠状态

- D.老鼠对突然的严重威胁的反应受其体内生成的一种化学物质的刺激,这物质与注射到老鼠体内的蛋白质相似

- 查看答案

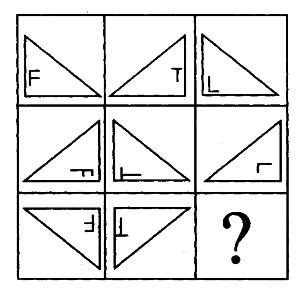

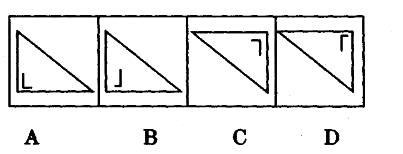

-

- A.见图A

- B.见图B

- C.见图C

- D.见图D

- 查看答案